- Panier est vide.

- Continue Achats

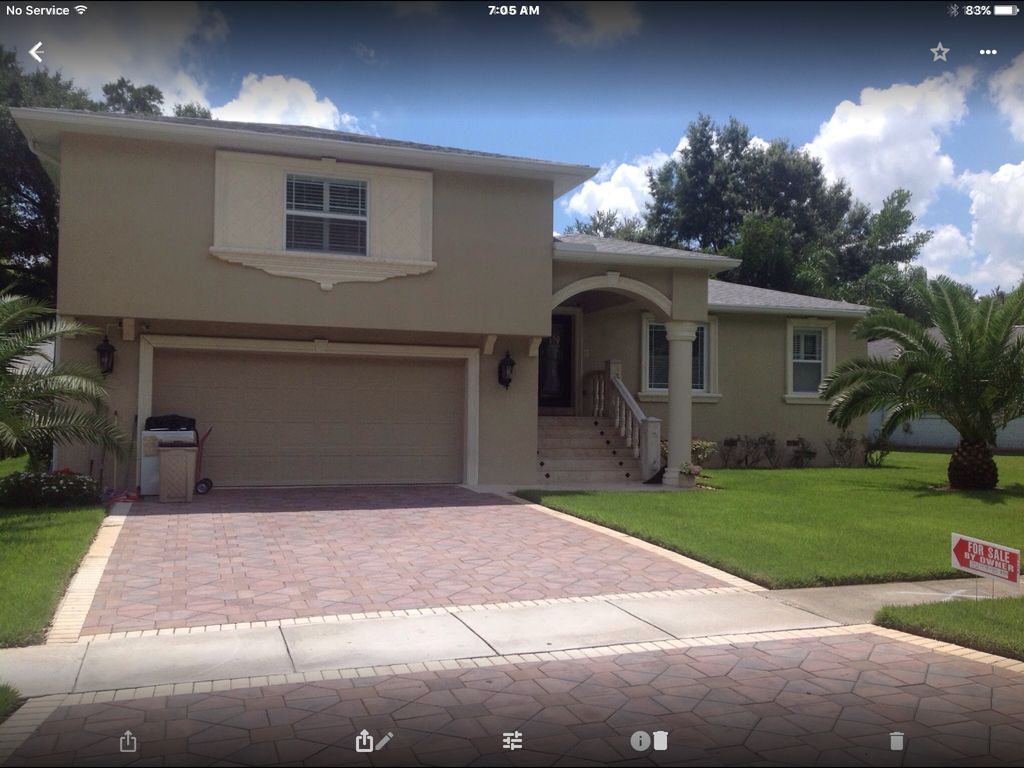

The huge benefits and Drawbacks of using Your residence since the Equity to have that loan

If you prefer a media otherwise higher sum of money right today and therefore are thinking about your resource choice, you may have probably been deciding on domestic collateral finance. These loans can in fact getting a good idea based your needs and you will borrowing from the bank problem, even so they is potentially dangerous.

This is your family we’re these are, and you will lenders will need your home or lead you to consent so you can very severe terminology to keep it if you are having difficulty using the loan back. This will be a good ily’s lifetime for a long time, so you you should never carry it softly. Let us glance at some of the advantages and disadvantages of using your residence since equity for a financial loan.

Specialist Could Provide Money with Poor credit

If your borrowing from the bank situation try bad otherwise less than excellent, upcoming delivering a collateral mortgage can https://elitecashadvance.com/personal-loans-il/chicago/avant/ make experience. The worth of your home together with level of equity you have involved make more of a big change than just your credit, so that are your best way to get the means to access a large mortgage instead good credit.

For those who only need a small or midsize financing, yet not, next remember that you don’t have to risk every thing simply locate use of resource. Particular properties will allow you to get finance North Ireland off any where from ?100 so you can ?10,000 even although you do not have a good credit score. Discover a help that will allow you to definitely contrast unsecured funds Northern Ireland anywhere between other business and certainly will inform you when the you’ve got a chance for taking approved or otherwise not before you could go through the application. For people who complement an effective lender’s standards, you may get financing quickly that you will be ready to repay like most other type from loan.

Swindle Their Property are on the new Line

New poor element of placing your house right up since equity was that you might eradicate it-all for a financial loan that you could’ve removed without the exposure and also you to definitely skipped payment would-be reasons behind a loan provider so you can start the brand new repossession processes.

Not only that, although rate it get having attempting to sell your house might not be enough to pay for sum of money you borrowed. If that’s the case, you could however end being required to make payments really immediately after our house is sold. That will be extremely demoralising that is anything plenty of property owners had a tough time experiencing, therefore think about you to before you play your home aside.

Professional You can acquire Additional money owing to a security Mortgage

Guarantee financing was regarded as much safer to have lending associations because the discover a real asset attached to them. And you may belongings are some of the best possessions as much as, and they keep their worth pretty well also. As a result of this you will get access to significantly more money if you decide to place your family up given that a pledge for the mortgage.

The price of borrowing from the bank money was lower too. It isn’t uncommon having lenders provide straight down APRs for all those that happen to be happy to put their house as the equity, once more, from the down imagined exposure, so this is a good reason about how to opt for it sorts of mortgage.

Scam The program Procedure Can be more Difficult

That doesn’t mean that obtaining a guarantee financing is a lot easier than just a classic you to definitely, although not. In fact, you can expect the method when deciding to take a whole lot more big date.

Consider, the lender needs to gauge the genuine value of your residence and can’t simply take their phrase for this. They may must upload anyone to appraise your house and you can will generally ask for considerably more details than for other type of loans. Thus, be equipped for it gruelling process and make certain that you have got all of your records managed.

Expert It might Help you Reconstruct Their Borrowing from the bank

Among the best ways if you have less than perfect credit to help you rebuild it is, ironically, to acquire a lot more. Given that taking a timeless financing would be impossible, bringing a collateral financing might possibly be good second option. However you have to be 100% sure if you’ll be able to pay off punctually per month. Skip that commission as well as your whole plan you will backfire, very be cautious.

Ripoff Cash Suspicion

You might think that you’ll be able to safety the loan today, nevertheless do not know what could happen one to, five, otherwise ten years from now. For individuals who out of the blue eliminate the capacity to make money or cure your work, then you may become losing your residence as well. Thus, need a lengthy hard look at your newest problem and you can court whether you are positive that you’ll be able to nevertheless be able to secure since the far money or more in the future.

To put it briefly

Putting your property up because the a promise for a financial loan was an incredibly risky move and one that’ll provides severe effects. Thus, take your time before you go completed with your choice and you will have a look at whether you could utilize a much safer alternative.