- Panier est vide.

- Continue Achats

First and foremost, their bank will at your credit history

dos. Reduce your financial obligation-to-earnings (DTI) ratio

As stated earlier, your own lender commonly learn the debt-to-income (DTI) proportion, which can only help determine your ability making month-to-month home loan repayments.

Definition, it go after a certain model known as qualifying proportion to determine while you are entitled to the best prices.

Merely, this laws ensures that you really need to invest just about 28 % of your own disgusting monthly earnings towards the total casing expenses and just about thirty six % on complete personal debt services (such as the the newest mortgage repayment).

The very best way to attenuate your DTI is to click for more info increase your income. Sometimes need a moment employment, score a part concert otherwise inquire about a raise.

Based on your financial updates and mortgage problem, you are in a position to refinance otherwise consolidate your own student loans to obtain a lower life expectancy payment per month.

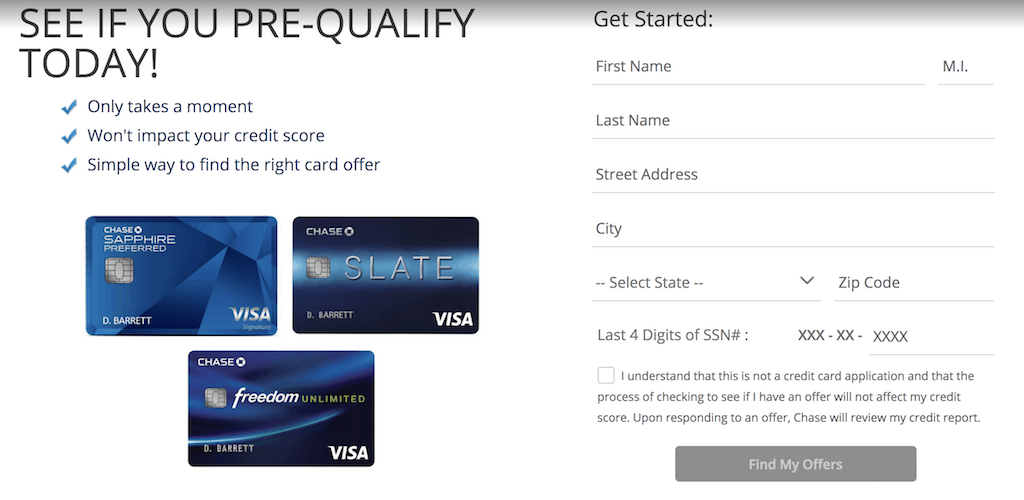

step 3. Score pre-recognized

Because the an initial-big date homebuyer, this is simply not strange to receive a tiny financial help away from your mother and father or an almost cherished one. Or participate in a neighbor hood homebuyer system.

Such fund are called presents, and they also should be acquired and cite by an excellent lender’s present letter. In the event it financial help is intended to be utilized for a advance payment, it must be sourced as a gift, maybe not that loan.

If you’re becoming pre-recognized, the lender will require particular information and data files away from you so you can accurately influence their eligibility.

Some elementary files is the W-2’s, two years away from federal tax returns, dos months’ work off lender comments and.

4. Think financial assistance

Based on just what condition and you can city you reside, you can find financial help programs people can enjoy.

Together with such financial help programs, the type of mortgage your chosen might help lessen the costs off a mortgage.

Including, for individuals who qualify for an enthusiastic FHA loan, their down payment will likely be little given that 3.5%. A good USDA mortgage likewise, demands no down payment, nevertheless these money was offered in the event you live in outlying areas.

Hold off it out

If it is difficult to manage and continue maintaining with latest money or if perhaps their money are in forbearance, it is best to hold off it out if you do not are financially in a position to cope with a mortgage.

You will also have becoming comfortable controlling a couple of highest debts over a long period of time. Your own number of income will be help you with confidence decide if your will be ready to deal with that kind of monetary obligation.

It could be frustrating to accept the reality that your own student loans was stopping you moving forward from investment home financing, nonetheless it could well be really worth the wait.

For individuals who impede your own plans for some even more years and you may features paid off a few of their student education loans or any other expenses, this may make it easier to be eligible for a diminished rate of interest otherwise a higher loan amount.

Concurrently, this more time can help you create a much better credit rating and you can financially balance out yourself to help you have the home off their aspirations.

Today, let’s put their bills. Ian features credit cards equilibrium having good $50 30 days minimum payment. Together with his education loan fee from $375 monthly.

d. Play with different varieties of borrowing from the bank Lenders need glance at your credit history just before they can approve your. If you have one obligations percentage, it’s hard for loan providers to gauge even when you could potentially manage a mortgage. Select different types of borrowing from the bank, particularly credit card money otherwise car and truck loans. This will show your bank you might handle other sorts of obligations.