- Panier est vide.

- Continue Achats

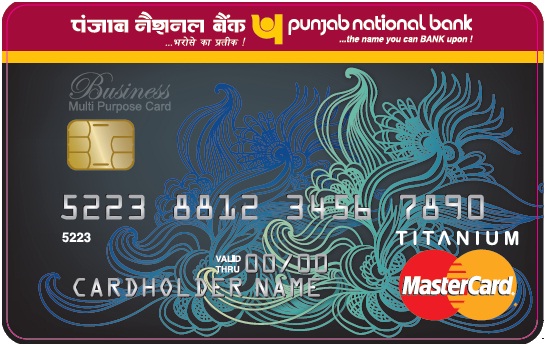

As opposed to bringing approved to have a timeless financial, you’ll need to get unique investment, normally a share loan

After you think about to buy a property, you think off property about suburbs to-name your own personal grassy front yard, picket wall, quaintly shingled roof which have a comfy little fireplace poking out. If you are that is yes a gorgeous alternative, it is really not the only person, and there’s many different types of belongings you could own. One selection for homeownership, especially if you live-in an enormous city, is co-op homes.

Co-op houses, informed me

Co-op property, quick for collaborative property, differs from a number of the more conventional homeownership selection. Co-op housing occurs when clients or co-op participants join to have a complete strengthening otherwise property, sharing obligation having repair. (Find out how individuals are cooperating?)

Regardless if co-ops will are available in multiple-product structures, brand new co-op model is different from to get a flat otherwise family because the you may be maybe not to get a certain unit you may be to get shares in a non-money firm one to owns this building. And you may in the place of hold a concept, because you do various other homebuying affairs, you own stock alternatively. Which common possession and duty build having an effective co-op a unique alternative. If you are co-ops aren’t simply for certain specified areas, he or she is much more common during the highest towns eg The York Town or Chicago.

Brand of co-ops

If you’re multiple-device flat buildings are prominent to possess co-op housing, co-op arrangements applies so you’re able to townhouses, are made home, single-loved ones land, duplexes and a lot more. There are even various indicates co-ops should be structuredmon co-op structures cover anything from:

- Markets rates co-ops: This allows users buying and sell offers within whichever rates industry enable.

- Minimal guarantee co-ops: It establishes limitations into rates of which offers will be purchased or offered.

- Local rental co-ops: Within this condition the fresh co-op cannot very own this building however, rents it from another individual. Contained in this circumstance, the new co-op doesn’t collect collateral on property.

Co-op maintenance charges

That have multiple owners carrying offers in one building, how come a beneficial co-op works with respect to maintenance fees? The cost framework to own co-ops differs than many other variety of owning a home.

Normally, the fresh new monthly restoration percentage includes that which you, like doing work costs, possessions taxation, strengthening insurance coverage and you can mortgage costs. Of a lot restoration costs may defense the cost of tools eg because heat and liquid, however constantly. The expenses is actually split certainly co-op members established exactly how many offers they own.

Co-op fees are set because of the co-op’s panel and you will shareholders must choose on them from the a stockholder conference. The newest charge are usually put by the many guidelines system. Whenever you are brief percentage increases are needed, either specific shareholders need to make expensive home improvements, like adding a health club, while others don’t think the additional improvement costs are beneficial. Thus, if the most desires one this new gymnasium, and you are on minority that doesn’t, you are however obligated to pay their share of will set you back.

Should your cooperative equipment repair charges are a device power charge, the constant maintenance costs ount regarding equipment electric fees which can be provided before calculating the fresh new houses costs-to-earnings ratio and personal debt-to-income proportion.

Co-op panel approval process

Another way to find to the a co-op differs from other sorts of homeownership ‘s the approval procedure. It is because you’re not actually purchasing assets, you will be to order stock in the organization you to definitely possesses the property.

To help you discovered funding recognition, a good collaborative display mortgage need to be a fixed rates, totally amortized first mortgage. A cooperative show home loan relates to a home loan which is particular so you’re able to cooperative construction, in which residents very own offers throughout the collaborative firm rather than having real estate downright. The newest repaired price, totally amortized first mortgage determine the https://paydayloanalabama.com/cottondale/ sort of mortgage necessary. It should has actually a fixed rate of interest (not adjustable), also it are totally amortized. It indicates the principal and you may desire is repaid completely of the the conclusion the borrowed funds label.