- Panier est vide.

- Continue Achats

Other Prominent Types of Insurance with the USDA Approved Belongings

Homeowners insurance try an effective way to protect your investment in your USDA-guaranteed household out-of fires, disasters, injuries, theft, or other types of destroy. It is one of the most first an effective way to safeguard your property regarding sheer and you can guy-produced disasters.

It is also things USDA loan providers will demand. Home insurance covers the equity, hence customers try not to fully very own until the loan was paid off into the full.

But home insurance is not only wise because it’s expected. Property is one of the biggest pick you can easily ever before build, therefore merely helps make good sense in order to ensure oneself up against losings.

There are different types of insurance, nevertheless the several head classes one to USDA individuals stumble on is actually home owners (often named hazard) insurance coverage and flood insurance policies.

Danger otherwise Homeowners insurance

This is basically the first type of insurance rates any type of financial, as well as of them backed by the newest USDA, will require you to definitely provides before you close.

You are going to need to prove you may have an insurance policy that you’ve pre-covered the first seasons. There is a variety of type of home insurance guidelines and you can coverages. Loan providers may have their own standards getting coverage, therefore chat to the loan officer on which you may need offered https://www.paydayloanalabama.com/gordonville your specific problem.

- Fire

- Lightning

- Hail

- Windstorm

- Thieves

- Vandalism

- Ruin out-of vehicles and flights

- Riots and municipal disturbance

- Volcanic eruption

- Glass damage

Very first threat insurance coverage cannot shelter flooding otherwise earthquakes. If you reside within the a flooding or disturbance-vulnerable area, you might have to remove a different policy to protect against those individuals disasters.

As well as earliest hazard insurance rates and you can ton otherwise disturbance insurance policies, there are some most other basic variety of insurance you should be aware of.

Using People and you may Ton Insurance costs

To own a beneficial USDA loan, you must have home insurance exposure into the quantity of the loan or what it do pricing to completely alter your domestic when it is lost.

Just remember that , the newest substitute for pricing varies compared to the number your house is really worth. Fundamentally, the latest substitute for pricing could well be utilized in their appraisal alongside the appraised well worth, and your insurance provider can come up with their guess according to research by the information on your property.

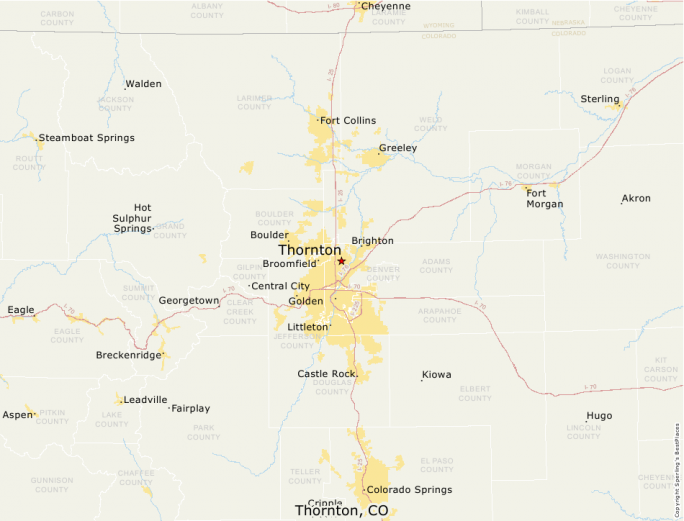

An abundance of situations enter determining exacltly what the advanced usually become, also in your geographical area, just what insurance company you will be playing with, what type of coverage you earn, their history of to make insurance claims, exactly what your residence is made of, and exactly how far it would rates to displace your property.

Additionally need certainly to ount is reasonable. Large deductibles will mean down yearly superior, however, which also means more cash out-of-pocket before insurance carrier chips in for people who document a claim.

Within closure, you are going to pay the entire earliest year’s premium included in your own closing costs. People normally query vendors to cover this cost within their transactions out-of settlement costs and concessions.

Next, you can usually shell out a portion of so it annual expenses every month in your regular homeloan payment. Loan providers often escrow such finance and you may spend the money for superior for your requirements when it is owed. Might normally carry out the same thing together with your yearly assets tax bill.

This is exactly why you can easily may see a home loan fee conveyed just like the PITI, and that signifies dominant, attract, taxation and you may insurance policies. Those four points compensate the fresh new monthly payment for the majority of USDA customers.

How-to Located Settlement to have Losings

In the event that things goes wrong with your property and you should build an insurance allege, you will be responsible for submitting new allege together with your insurance carrier.

Another strategies will vary by insurance company, however, essentially, you’ll be able to tell them what happened, and they’re going to send out an adjuster to choose whether you’re secure, and also for just how much.

After that determination is made, this is your obligation to pay their allowable and you may discuss with your insurer if you believe eg you’ve been unfairly settled.