- Panier est vide.

- Continue Achats

USDA Finance The state: The fresh new Zero Advance payment Zero Brainer

The journey to homeownership is commonly paved that have demands, specifically for first-go out homeowners inside the Their state, where real estate market and cost regarding traditions is infamously high priced. Yet not, the united states Agency of Agriculture (USDA) financing program shines as the a great beacon of a cure for of a lot. Made to give rural innovation to make homeownership even more available, new USDA loan also provides many perks making it an educated first-go out homebuyer program inside the The state. Including no down payment standards, competitive rates, and lower mortgage insurance fees than the antique fund.

Brand new genesis away from my Their state investment property strategy first started on the USDA financing. We utilized the system to purchase my first household in the Makakilo getting $210,000 because a bankrupt single father having 1 year old de- however the USDA loan anticipate us to keep it currency and use it on the upgrades yourself. I would book our home aside the following year to possess positive cashflow and 36 months next, We sold the house getting $376,000 and you may rolling my winnings into the an effective 4-unit leasing possessions playing with an effective 1031 Replace. I’d use the Their state 1031 Replace again two years later to sell so it assets and you can roll it with the a beneficial duplex inside the newest Diamond Head urban area well worth $step one.5M now and you may disgusting rent off $8,000/mo — all of the of a no advance payment financing I got produced many years previous!

Qualifications

Eligibility getting a USDA financing is based on numerous criteria, in addition to income, credit score, and the location of the property. To qualify, applicants need to meet particular money limitations, which are built to make sure the program provides people that it is are interested. Also, the house need to be located in a qualified rural or suburban urban area, indicated of the white parts on the map less than. Even if Hawaii is commonly of the active urban centers and lavish resort, many parts of the state qualify due to the fact outlying based on USDA standards, putting some financing great for homeowners.

Qualified Neighborhoods toward Oahu

Ewa Coastline – A quickly developing neighborhood into southwestern coast of Oahu, recognized for the newer single-family unit members residential property, townhouses, and sophisticated golf programmes. It offers a mix of domestic morale and benefits that have availability in order to beaches, stores, and you may entertainment institution.

Kapolei – Also referred to as « Oahu’s 2nd City, » Kapolei was a master-organized area that have a variety of home-based, commercial, and you can industrial section. They enjoys progressive features, universities, shopping centers, and you can progressively more job opportunities, making it an exciting location to alive.

Regal Kunia – A mainly agricultural city who’s seen a transition to incorporate much more residential improvements. It is known for their quiet, outlying means that is where you can find the Kunia Nation Facilities, one of the biggest aquaponic facilities throughout the county.

Waikele – A residential district community recognized for its well-arranged residential areas and the common Waikele Superior Shops. This has a variety of residential coping with convenience in order to looking and restaurants options, plus easy access to roads.

Waianae – On the western coast regarding Oahu, Waianae was a residential district that have a powerful Indigenous Hawaiian population, giving a more affordable housing marketplace and you may stunning charm, along with clean beaches and you can walking trails.

Northern Coast – Greatest global for its surfing coastlines such as for example Waimea Bay and you may Sundown Seashore, the fresh new North Coastline are a more placed-right back, outlying area of Oahu. It’s noted for their small-area be, farming lands, and you may a rigorous-knit area worried about outdoor life style and maintenance of absolute ecosystem.

Kaneohe (north away from Haiku Roadway) – A rich, home-based town characterized by its amazing opinions of one’s Koolau Mountains and you will Kaneohe Bay. It offers a combination of rural and you may residential district lifestyle, with use of drinking water affairs, botanical gardens, and walking trails. This place is recognized for the peace and you will beauty, providing a calm mode off the busyness of city lives.

Money Restrictions

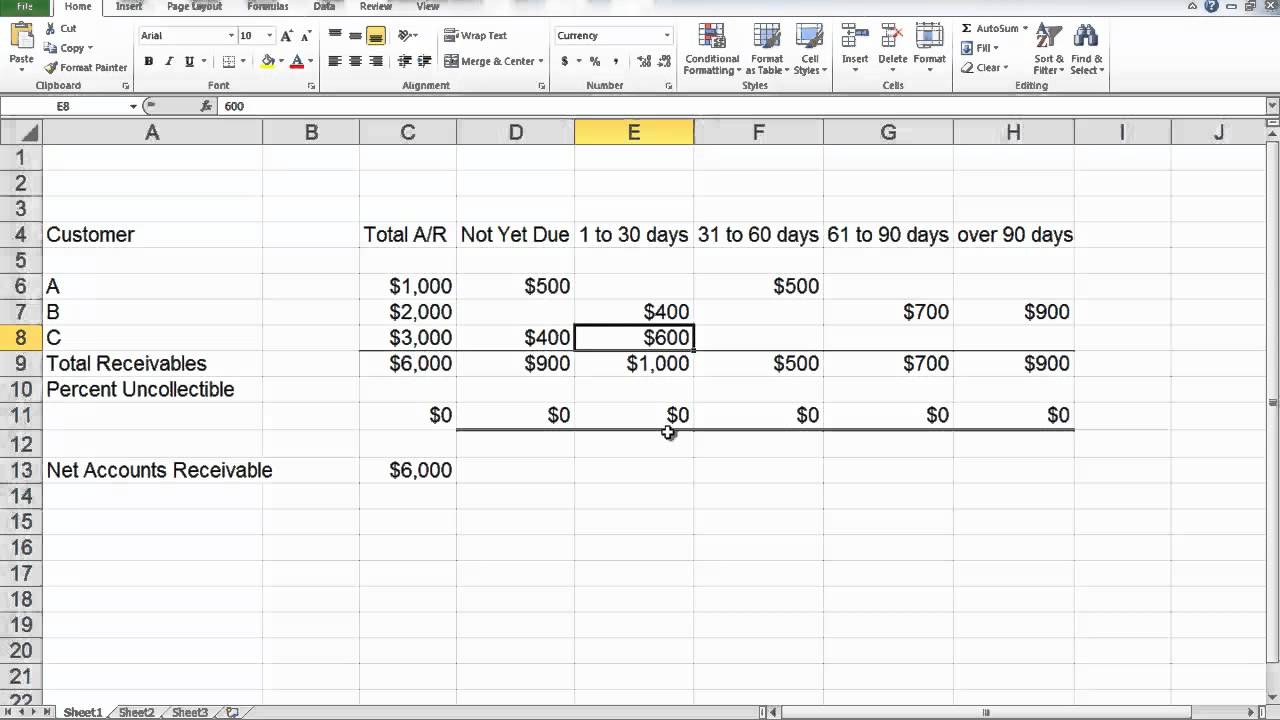

Income restrictions to have USDA money within the Hawaii are ready based on the median income quantities of the space while the sized cash advance AL Flomaton the household. Such limitations are adjusted a year and are supposed to make sure the latest fund is actually accessible to individuals and you may family members which have modest revenue. The new dining table below represents brand new Honolulu County earnings limits between a household of 1 so you can a household off 8. Make sure to reference the bottom line « Mod. Inc-Guar Financing. »

Such, a family group out-of five to buy property within the a specified rural city into the Oahu might find that they have to keeps an enthusiastic modified gross income that doesn’t go beyond $150,650/yr.

Difficulty

Navigating the new USDA loan procedure is easier than just of several first-big date homeowners you are going to expect, especially when compared to the most other loan sizes. The answer to a silky app techniques is preparation and working which have a lender experienced in USDA fund. People need to have its monetary data files under control, together with income confirmation, credit file, or any other associated files. Whilst the program’s zero advance payment criteria significantly lowers the brand new barrier to homeownership, applicants still need to have indicated creditworthiness therefore the capacity to pay the mortgage.

Operating Big date

New processing time for USDA funds may differ according to numerous affairs, such as the lender’s workload, the new completeness of the app, and requirement for a lot more documentation. On average, the method usually takes from 45 to two months of application in order to closing. It is important for applicants to your workplace directly the help of its financial and you will operate timely to help you requests for recommendations to prevent too many waits.

To own earliest-date homebuyers during the The state, the USDA loan program offers an unequaled possible opportunity to go homeownership in one of the most incredible towns in the world. Having gurus such as for instance zero advance payment, less mortgage insurance rates, and you can aggressive interest rates, it’s no surprise as to the reasons so many find the USDA mortgage while the its portal to homeownership. By knowing the qualifications requirements, money constraints, and you will get yourself ready for the program techniques, possible homebuyers is navigate your way confidently, and then make its dream of owning a home into the The state a real possibility.