- Panier est vide.

- Continue Achats

5 Factors to Come across When buying Property That have Student training funds

The fresh think of many, together with typical way for People in america to create riches, is basically to invest in a house. That is getting increasingly out-of a dream for those graduating that have grand student loan financial obligation. This short article talks about purchasing a home that have education loan financial obligation. For those who have figuratively speaking and therefore are probably pick a domestic, in the process, or loans Blue River was indeed denied home financing next this short article is for the.

Table Of data

- As to why The tough discover Help & Where you might get It

- To invest in A home Which have Student loan Fund: The big Condition

- Not totally all Student loan Payment Plans Was Managed Equivalent

- Purchasing Possessions When using the A wages-out of Technique for Their Student education loans

- To shop for A house While using Financing Forgiveness Way of Their College loans (IBR, PAYE, REPAYE, PSLF)

As to the reasons The hard to find Assist & Where to get It

Large Package creditors as well as their groups away from go out so you’re able to day allow impossible to acquire investment. Because of the Large Plan I am discussing lenders and Lender Regarding America, Wells Fargo, an such like… The tough to locate a home loan with the aid of the individuals when you features college loans mainly because companies processes of many, if not many programs per year.

They have cookie cutter activities to determine for folks who be considered to possess resource or otherwise not It indicates, it collect your computer data, connect they with the a credit card applicatoin, and a reply are spit out.

Should you get refused the hard regarding regulate how in order to get approved as step one) the staff are very active functioning software they just you want certainly to maneuver onto the second borrower (i.elizabeth. the reasonable clinging fruits that is simple to score certified) and you may 2) they’re not trained to your things such as college loans.

For this reason, he has got no way of trying so you’re able to figure brand name the fresh research in order to be considered (below in this post we talk about ways to shape amounts). The answer, get a hold of a mortgage broker on the believe that knows what they create. He could be out there, you just need to research somewhat.

Higher Beginner Debt and buying A home: The major State

Based on CNBC, 83% of individuals years twenty two-35 hence have not purchased property blame their figuratively speaking. Due to college loans, of many are unable to be eligible for a home loan. not, they won’t see why.

You can find three top items that dictate certificates with home financing: Borrowing from the bank (its FICO Score), LTV ratio (Loan-To-Worthy of otherwise how much mortgage their apply for before brand new worth of your property), as well as your DTI ratio (Debt-To-Income) The primary reason we see student loan consumers maybe not qualify getting a mortgage ‘s the debt-to-money ratio (DTI).

Below is actually a typical example of why which is. Later with the post We explain ways to maybe let their qualify for home financing of your own optimizing their DTI proportion.

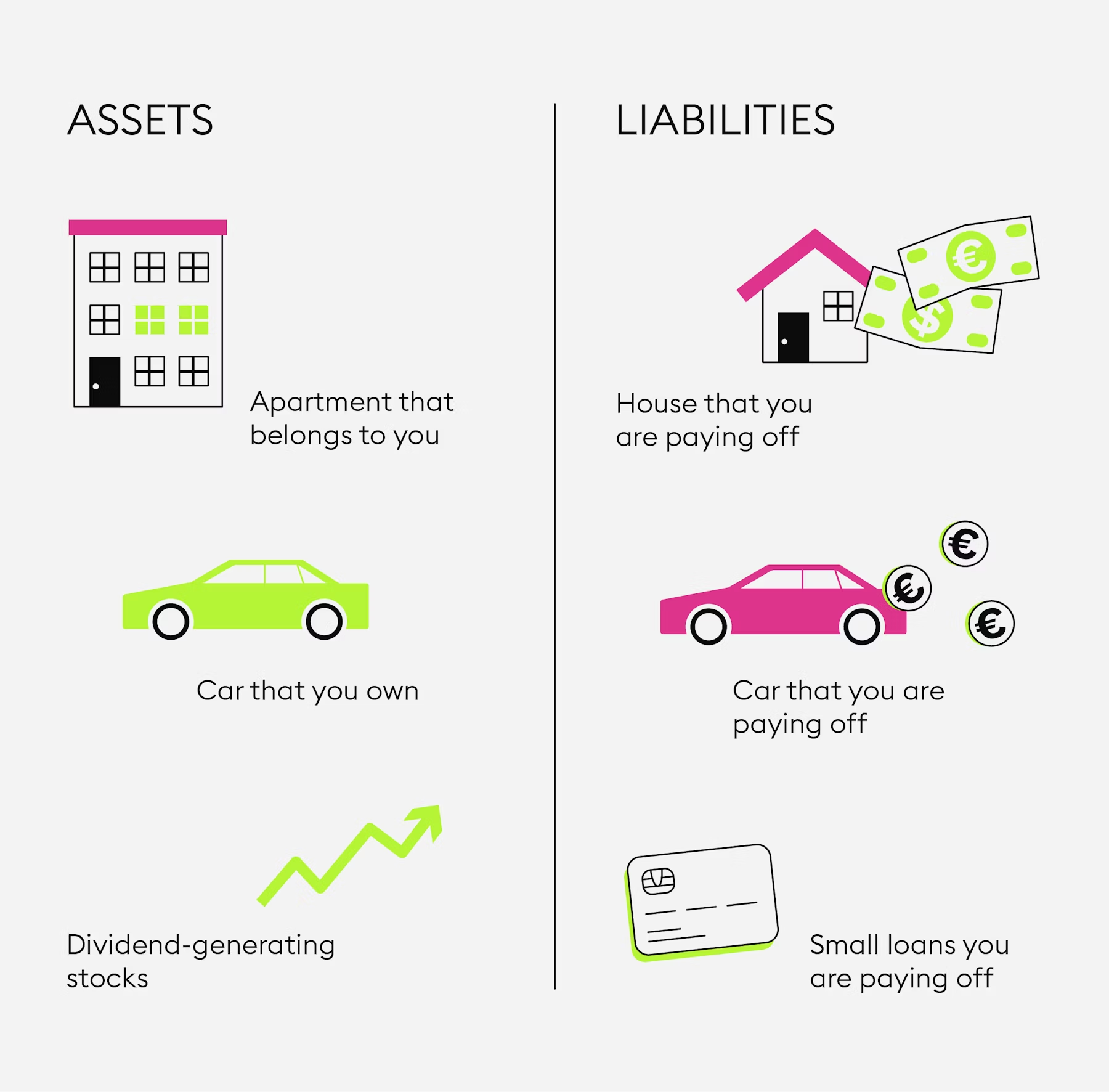

Earliest anything earliest even in the event, what’s DTI. It is its full loans duty separated of complete unpleasant income. From the complete i would recommend Georgia cash advance all of the monthly obligations for the brand new money… Student loans, automotive loans, playing cards, an such like…

When you are buying a house, the lending company boasts the loan payment, assets taxation, homeowners insurance guidelines and you can HOAs towards and that formula. So you can be eligible for a home loan your own DTI ratio can not be more than forty-five% 55%. Lower than is largely an illustration one to illustrates new DTI algorithm.

A graduate College Analogy

An individual having a scholar studies was previously an automatic in order to qualify for home financing. not, who has got altered because of figuratively speaking For the next analogy, we shall use actual knowledge i have collected off FitBUX professionals.