- Panier est vide.

- Continue Achats

Votre réception reflète la personnalité de votre entité

Des comptoirs aux matériaux nobles et au design unique

DÉCOUVRIR

Possibilité de fabrication sur-mesure

Nous pouvons ensemble trouver les solutions à l’ensemble de vos problématiques

DÉCOUVRIR

Notre équipe est à votre disposition

Nos conseillers professionnels sont dédiés au suivi de vos demandes et requêtes

DÉCOUVRIR

Un service après vente dédié

Nos conseillers sont là pour vous répondre avant, pendant et après la vente

DÉCOUVRIR

DÉCOUVRIR

Garantie réelle sur nos produits qui varie de 1 an à 5 ans

DÉCOUVRIR

Accompagnement dans l’agencement de vos espaces de travail

DÉCOUVRIR

Possibilité de personnaliser vos modèles , vos dimensions ou vos coloris

DÉCOUVRIR

BUREAUX DE DIRECTION

14 articles

BUREAUX COLLABORATEURS

16 articles

TABLES DE REUNION

14 articles

SIEGES DE BUREAU

21 articles

CLOISONS

4 articles

RANGEMENT & RAYONNAGES

26 articles

COFFRES FORTS

10 articles

Shop

0 articles

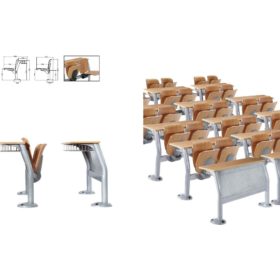

MOBILIER SCOLAIRE

3 articles

MATERIEL DE BUREAU

4 articles

SALLES DE CONFERENCE

7 articles

Recommandations

Produits Populaires

Livraison & montage

Disponible partout au Maroc

Support technique et commercial

À votre écoute

Promotions & réductions

Pour les clients fidèles